The GO4CIRCULAR’s introductory event was a great opportunity to explore how small and medium enterprises; particularly in the textile and agriculture sectors can embrace circular practices to reduce waste, innovate, and grow sustainably.

The GO4CIRCULAR’s introductory event was a great opportunity to explore how small and medium enterprises; particularly in the textile and agriculture sectors can embrace circular practices to reduce waste, innovate, and grow sustainably.

The Malta Chamber of SMEs successfully organised another edition of the highly anticipated SME Conference 2025, attracting over 300 business leaders, entrepreneurs, and professionals from across Malta. The event served as a dynamic platform for networking, knowledge sharing, and exploring opportunities for business growth.

This year’s edition featured an inspiring keynote address by Mr. Jasmin Alic, an internationally renowned speaker and leading voice on LinkedIn, who captivated the audience with insights on leadership, innovation, and digital engagement.

Following the keynote, participants had the opportunity to attend a series of four engaging workshops designed to address key areas of business development. These sessions covered The Use of AI in Business, Upskilling and Retaining Employees, Understanding EU Funds, Access to Finance & Incentives, Scale, Grow, Fund: Mastering Business Success, and Effective Recruitment, Sourcing of TCNs, and the New Labour Migration Policy.

Through these workshops, attendees gained valuable practical insights and tools to strengthen their operations and prepare for future challenges. The SME Conference 2025 reaffirmed the Chamber’s ongoing commitment to supporting the local business community and driving innovation, growth, and sustainability within Malta’s SME sector.

On Thursday, 4th December, AE Business Advisors invites Malta’s SME community to the Hyatt Regency in St Julian’s for the Shape Your 2026 Financial Strategy Business Breakfast, an exclusive morning of insights, strategy, and networking designed to help business owners, founders, and decision-makers turn financial data into clarity as they prepare for 2026 with confidence.

The morning begins at 9:00 a.m. with breakfast and networking, giving attendees the opportunity to connect with fellow business owners and professionals through meaningful conversations about shared challenges and growth opportunities.

At 10:00 a.m., AE’s Head of Sales & Marketing, Mr Gilbert Formosa, will deliver the keynote, sharing insights into the challenges growing organisations face when financial clarity is lacking, how a fractional CFO can bridge the gap between the need for financial leadership and the ability to afford it, and the tangible value this role brings to the business. His talk will also explore the human dynamics involved in navigating this transitional phase.

Following the keynote, there will be a short coffee break, after which AE’s team of finance experts, along with guest industry professionals, will lead an interactive panel discussion on real-world financial challenges, strategies, and solutions.

Attendees will be encouraged to ask questions and contribute their experiences, making the session practical, engaging, and directly applicable to their own business planning.

Running a growing business can feel like chaos; books to balance, decisions to make, and never enough time or resources to focus on the finances that really matter. Hiring a full-time CFO might be out of reach, yet relying on bookkeeping alone leaves you flying blind. This business breakfast is designed to give SME owners and decision-makers practical insights, actionable strategies, and real-world frameworks to regain control, make smarter financial decisions, and confidently steer their business into 2026.

Participants will leave with:

Seats are limited to ensure a focused and high-value experience. Register your interest here and a member of our team will get in touch to confirm your attendance.

This event is hosted by AE Business Advisors, a leading Maltese advisory firm with an expert, licensed team serving clients across multiple industries, both locally and internationally. Offering a wide range of services, AE helps SMEs achieve clarity, control, and growth through strategic finance, management insight, and hands-on business support.

*Sponsored article by AE Business Advisors

You are kindly being invited to take part in this research study conducted by Christine Marie Bezzina, as part of the requirements for her dissertation pertaining to her Masters in Business Administration at Warwick University.

Please take the time to read the following information carefully. Kindly contact the researcher at , if there is anything that is not clear or if you would like more information on the study being conducted.

Click here to participate in research

This comprehensive study aims to identify service gaps and opportunities for improvement that could benefit the entire Maltese business community.

Following the Budget speech, the SME Chamber welcomes the 2026 Budget which will assist SMEs to grow and remain competitive. Initiatives such as the improvement of the Micro Invest Scheme, the increased support for digitalisation and the incentive to invest in R&D are among the measures that will help businesses strengthen and expand.

The SME Chamber notes that a number of its proposals were taken up by the Government and acknowledges that, in preparation for this Budget, the Government, particularly the Minister for Finance organised several consultation meetings with the SME Chamber.

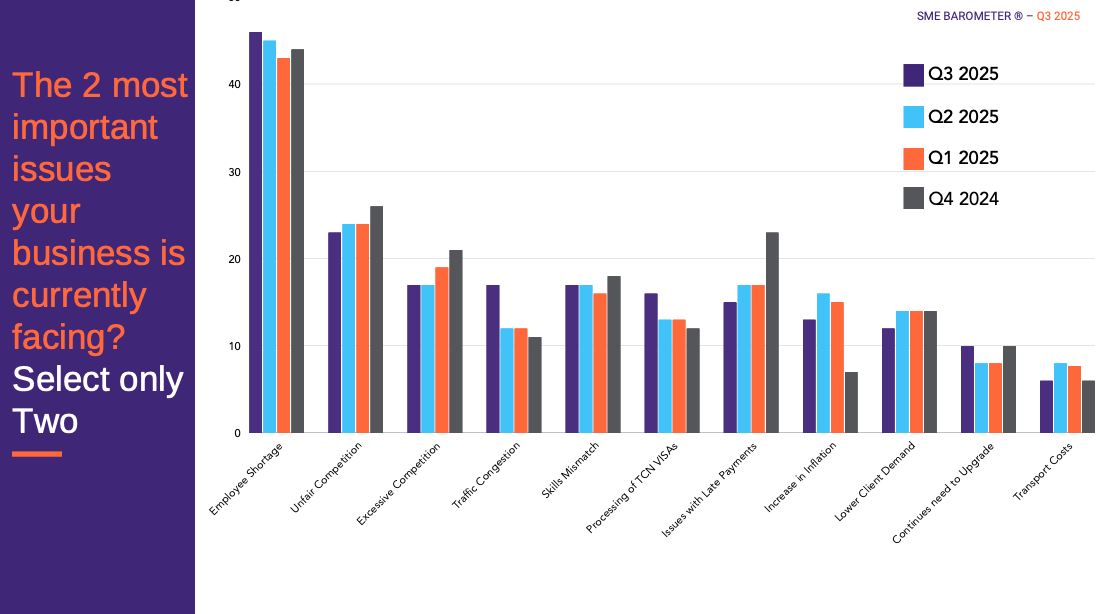

The SME Chamber’s proposals were developed using insights from the quarterly SME Barometer, which consistently gathers feedback from businesses, as well as input from members and targeted focus group discussions. The SME Chamber urges the Government to continue addressing the issues highlighted by businesses in the SME Barometer over the past months, including employee shortages, unfair competition, good governance, and traffic congestion.

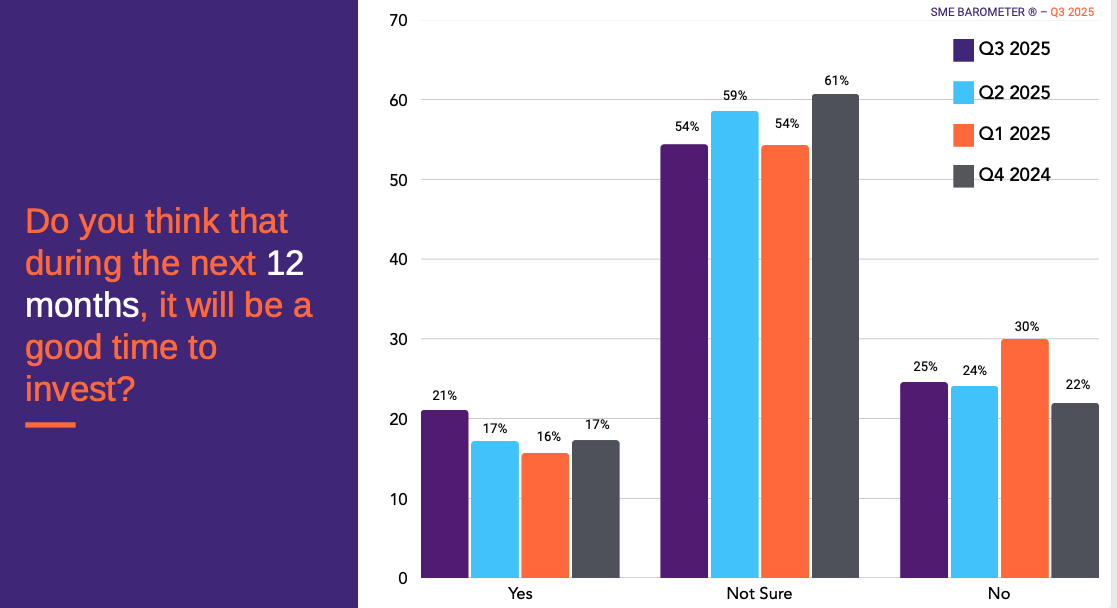

The Malta Chamber of SMEs, in collaboration with MISCO, has published the results of the latest SME Barometer (Q3 2025) survey. The study was conducted among 456 businesses between the 6th and 16th of October 2025.

When asked about the most pressing issues affecting their businesses, respondents identified employee shortages as the top concern (46%), followed by unfair competition (23%) and excessive competition (17%). Other key challenges cited include traffic congestion and skills mismatches.

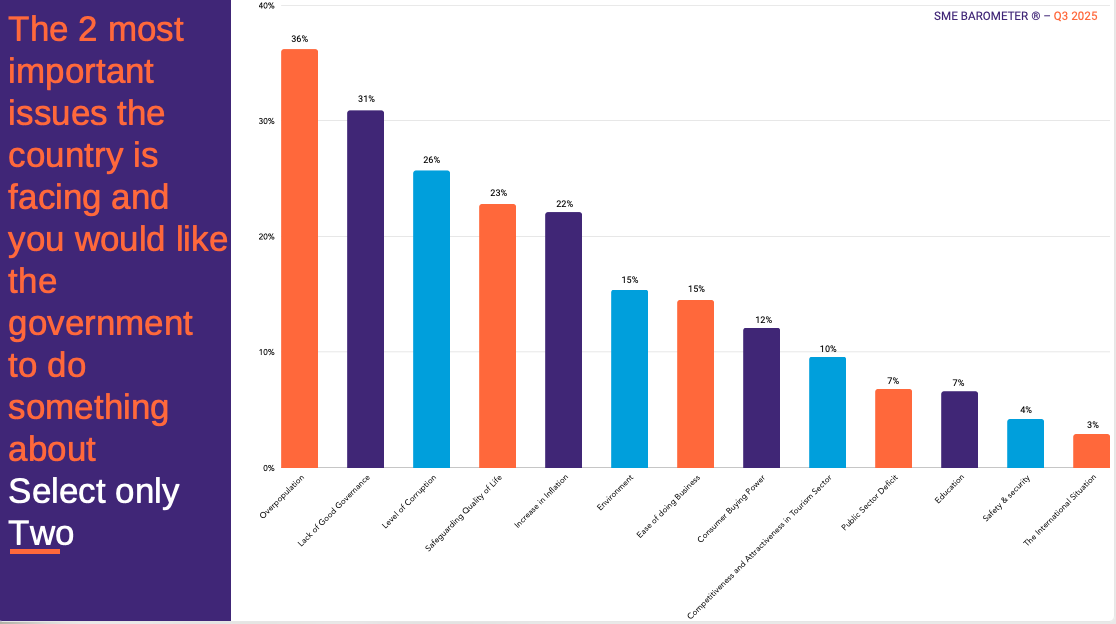

At a national level, overpopulation (36%) remained the most significant concern for SMEs. Other ongoing worries include the lack of good governance (31%) and corruption (26%), while safeguarding quality of life saw a notable increase in importance, rising from 15% in Q2 to 23% in Q3, making it the fourth most frequently mentioned issue.

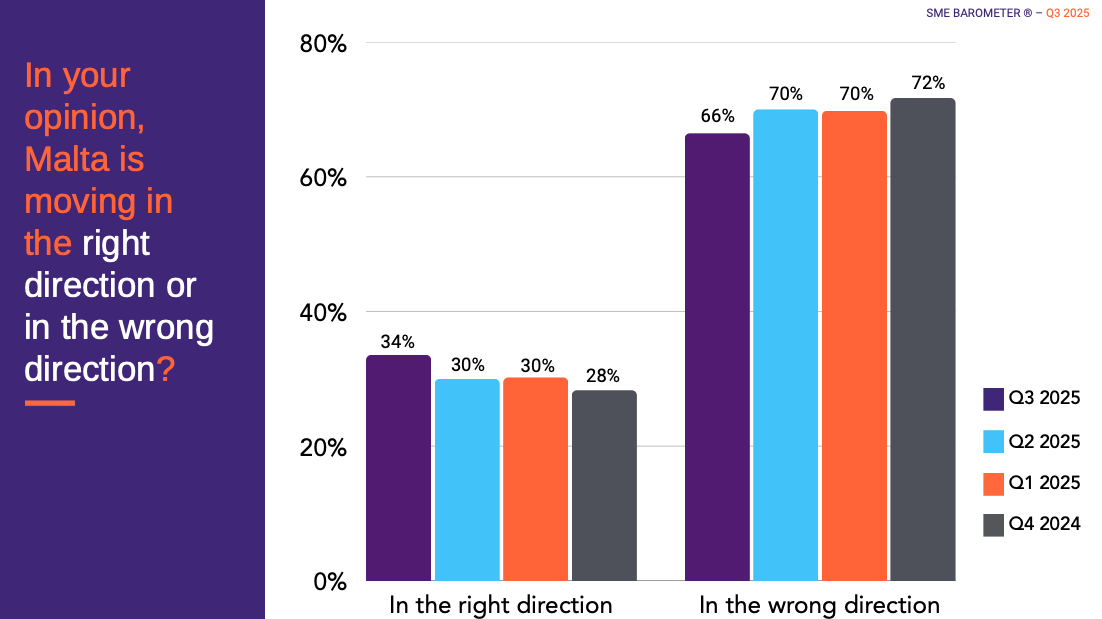

Business sentiment showed a slight improvement compared to previous quarters; however, 66% of respondents still feel that Malta is moving in the wrong direction. A slightly larger proportion of businesses expressed optimism about the next 12 months compared to Q2.

A special section of the survey focusing on digital transformation revealed that a strong 77% of SMEs recognise the importance of digitalisation for future growth. Among them, 51% are actively investing in digital tools, while 26% acknowledge its importance but struggle with implementation.

The SME Chamber urged the Government to expand financial incentives, such as grants and tax credits to support wider digital adoption.

The SME Chamber recommends increased support for micro and small businesses, including:

SME Chamber President Mr. Paul Abela stated that “SMEs continue to demonstrate resilience and adaptability, but they need clarity, consistency, and fairness from institutions.”

SME Chamber COO Mr. Andrew Aquilina emphasised the need for Budget 2026 to strengthen support for micro and small businesses, and to enhance schemes and incentives that have historically provided critical assistance to these enterprises.

The SME Barometer Survey is a collaborative initiative between the Malta Chamber of SMEs and MISCO.

Click here to download full results.

Following the recent debate on the potential introduction of a four-day working week, the Malta Chamber of SMEs believes that such proposals are premature and should only be considered following extensive consultation and studies with all relevant stakeholders.

While the SME Chamber strongly believes that employee wellbeing is an essential pillar of sustainable business practices the SME Chamber expresses several concerns, particulalry related to productivity, cross-sector competitiveness, and other immediate and long-term implications of such proposals.

Representing Small and Medium enterprises, which make up over 99% of Malta’s economy, with 97% being micro-businesses employing fewer than 10 people, the SME Chamber notes that a 20% reduction in productivity time (as would result from a four-day, 32-hour week) would have a significant negative impact especially on the micro companies. For instance, in a standard business employing 5 employees, this measure would effectively equate to bringing the workforce down to 4 employees.

On the other hand, a 40-hour, four-day work week would also have an impact on productivity, operations, and increase costs across several sectors.

The SME Chamber therefore calls for a constructive dialogue, free from partisan politics and a cross sector evidence-based studies to assess the impact of such measures particulary on micro and small enterprises.

Council members of the Malta Chamber of SMEs, together with members of staff, attended an event organised by Her Excellency Myriam Spiteri Debono, President of Malta, during which she hosted members of the Malta Council for Economic and Social Development (MCESD) at San Anton Palace.

She also encouraged representatives to extend their support to the Malta Community Chest Fund.