Over 185 participants attend webinar on latest updates in TCN recruitment

12 February 2026

The Malta Chamber of SMEs, in collaboration with the Institute of Tourism Studies (ITS), and...

Energy and Enterprise Minister Miriam Dalli together with Malta Enterprise CEO Kurt Farrugia announced that the MicroInvest scheme has been extended.

The MicroInvest scheme is applicable for the self-employed, micro enterprises and SMEs employing up to 50 people. Through this scheme, businesses are encouraged to invest in their businesses and part of the money invested would be converted into tax credits.

The investment by businesses could include refurbishment of facilities, new equipment, new vehicles used for work, and also salary increases.

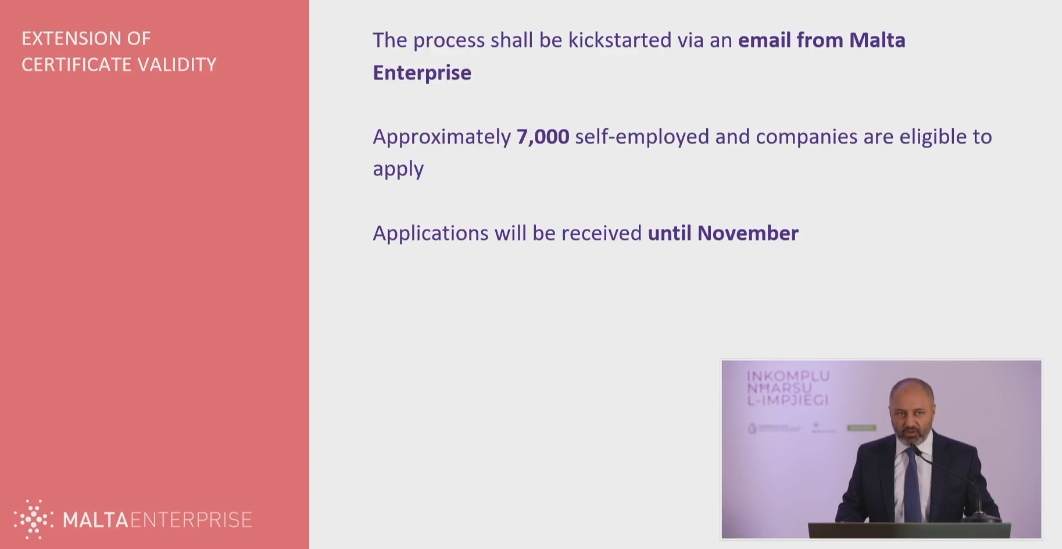

The new extension tackles the issue of low sales figures which meant that some businesses couldn’t benefit from the tax credit. Businesses will now have three more years to use their MicroInvest tax credit certificates.

There are 7,000 self-employed and small businesses that are eligible to apply for this scheme. So far since January 2019, €84 million has been provided to businesses through this scheme.”

Businesses who can apply for the scheme have to fall under a specific category according to their Planning Authority permit.

Other categories are there for retail, financial, food and drink establishments, offices and all industry premises.

A business that buys an internal combustion engine could benefit from a tax certificate amounting to a maximum of 30% of the value of the vehicle.

Buying a plug in hybrid or an electric vehicle for your business would entitle the business for a minimum of 45% tax certificate on the value of the vehicle.

The Malta Chamber of SMEs represents over 7,000 members from over 90 different sectors which in their majority are either small or medium sized companies, and such issues like the one we're experiencing right now, it's important to be united. Malta Chamber of SMEs offers a number of different services tailored to its members' individual requirements' and necessities. These range from general services offered to all members to more individual & bespoke services catered for specific requirements.

A membership with Malta Chamber of SMEs will guarantee that you are constantly updated and informed with different opportunities which will directly benefit your business and help you grow. It also entails you to a number of services which in their majority are free of charge and offered exclusively to its members (in their majority all free of charge).