Incentives for Bicycles and Bicycle-related facilities launched

23 June 2025

Transport Malta launched a number of incentives for Bicycles and Bicycle-related facilities. This new financial...

Following the urgent informative Webinar with the participation of the Customs Department and Taxation Department, we are communicating updates and clarifications related to Brexit.

This webinar was an opportunity for businesses to communicate about the preparations that need to be made and to understand the new realities that Brexit will bring.

If goods originate (manufactured or grown) in the UK, one may be able to claim a preferential rate of duty when these are imported into Malta and released for free circulation. This means they’ll be free (or benefit from a reduced rate) of Customs Duty. VAT will still be due on import.

To claim preferential rates of duty, the imported product must originate in the UK (as the exporting country) as set out in Chapter 2 of the Trade and Cooperation Agreement ‘rules of origin’ and Chapter 2 of the Union Customs Code.

One is to properly classify the specific product originating in the UK, to be able to assess the duties and specific provisions associated with it, against the TARIC database. The TARIC database is available on the Customs Department’s website, as follows:

https://ec.europa.eu/taxation_customs/dds2/taric/taric_consultation.jsp?Lang=en

To benefit from preferential tariffs when importing into the EU from the UK, the importer will be required to present a declaration that they hold proof that the goods comply with the rules of origin.

Entitlement to claim the preferential rate of duty is subject to a statement on origin that the product is originating made out by the exporter.

If goods do not meet the rules of origin requirements (or if proof of origin cannot be provided) Customs Duty still needs to be paid.

The procedures for exporting goods to the UK will be the same as those currently employed for exports to other third countries. However, the agreement provides for preferential treatment of goods originating in the EU for UK importers. In order to fulfil this provision, economic operators who export goods to the UK need to register in the REX System. These economic operators are guided to contact the Special Procedures Unit on 25685141 and 25685156 in order to initiate their registration process.

All relevant information associated with the procedures to be followed upon imports from and exports to the UK can be found in the Guidance Note – Withdrawal of the United Kingdom and EU Rules in the Field of Customs, including Preferential Origin – https://ec.europa.eu/taxation_customs/United Kingdom_withdrawal_en.This is also available on the website of the Customs Department.

The EU-UK Trade and Cooperation Agreement creates a free trade area with zero tariffs and zero quotas. Nonetheless, this does not mean that the status quo is being maintained – some goods may still be subject to customs duties, and all goods would need to go through the customs formalities.

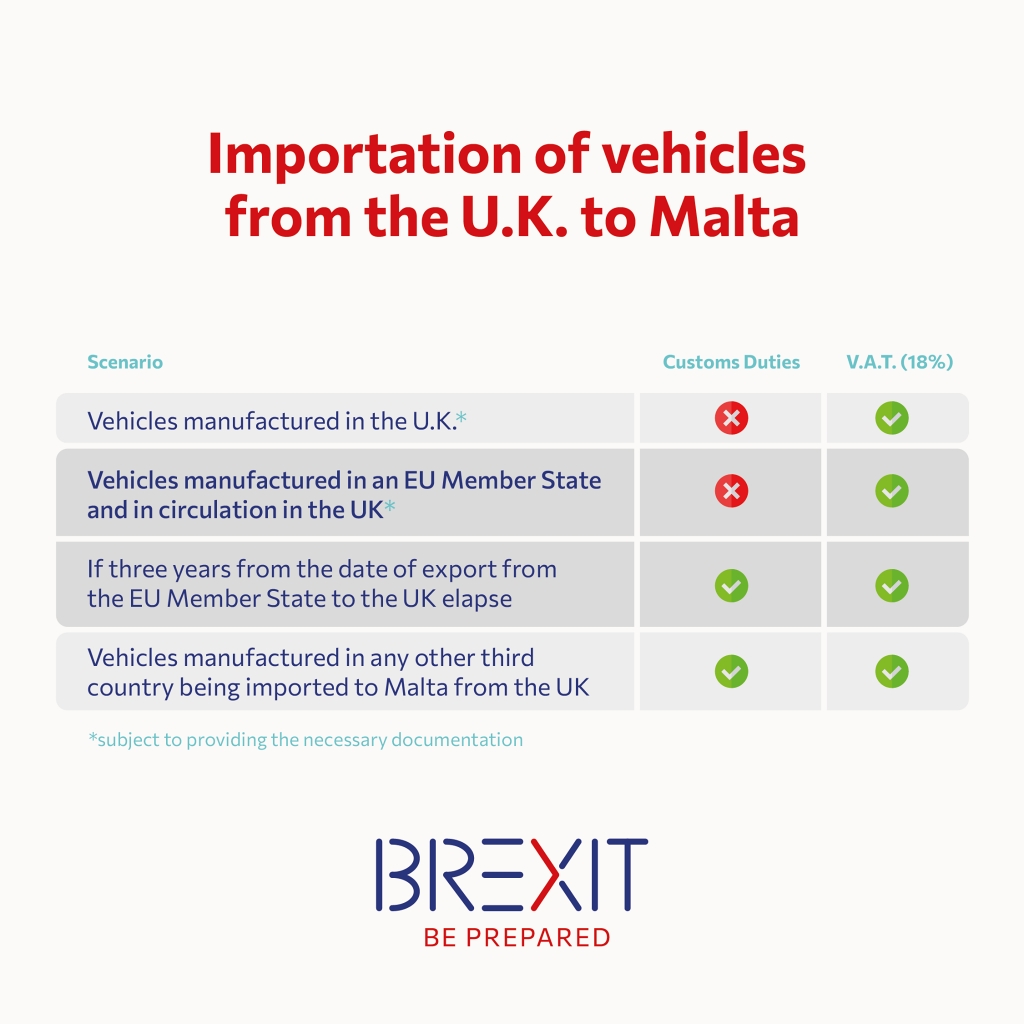

This applies also to vehicles being imported from the UK. The below table outlines the different scenarios of when customs duties and V.A.T would need to be paid.

For more information, one may also refer to the notice issued by the Customs Department on the Rules of Origin of goods:

Malta Enterprise invites businesses and self-employed operating from Malta to take a Brexit Impact Check through the newly launched Brexit website: brexit.maltaenterprise.com

The website aims to serve as repository of information for businesses who following the EU-UK Trade and Cooperation Agreement, which had been reached on 24th December 2020, are in the process of understanding the full impact of this new reality on their business.

The structure of the website provides a user-friendly question and answer format, which guides the businesses accordingly. The website also links the users to other government entities such as Customs Department, Malta Competition & Consumer Affairs Authority (MCCAA), Environmental & Resources Authority (ERA), and the Commerce Department, the Medicines Authority, Transport Malta, the Plant Health Directorate and the Information and Data Protection Commissioner website.

The Brexit Impact Check is the result of collaborative exercise among various government entities in order to assist businesses that may be effected in one or more of the following matters: (i) Imports, (ii) Exports, (iii) Services, (iv) Transport, (v) Supply, (vi) Digital Data and Services, and (vii) Intellectual Property Rights.

Businesses are also encouraged to familiarise themselves with the content on other government websites such as that of Customs, MCCAA, the EU Coordination Department (formerly known as EU Secretariat) and the Commerce Department, among others.

The Brexit Impact Check serves as a starting point and will be updated from time to time in order to reflect new details and more in-depth information generated from interactions with local and international authorities; as well as feedback and interactions with clients in relation to more specific cases.

Businesses are encouraged to submit their questions and suggestions on .

Anyone wishing for more information should visit the site www.brexit.gov.mt, which is constantly updated with notices and informative material. Direct assistance is being offered to citizens via the Brexit helpline on number 153 and to businesses on the BusinessFirst helpline on number 144. Help is also provided via e-mail on the address , where more individual and specific questions may be addressed.

Members requiring further information or clarification can either get in touch on or by phone on 21232881.

The Malta Chamber of SMEs represents over 7,000 members from over 90 different sectors which in their majority are either small or medium sized companies, and such issues like the one we're experiencing right now, it's important to be united. Malta Chamber of SMEs offers a number of different services tailored to its members' individual requirements' and necessities. These range from general services offered to all members to more individual & bespoke services catered for specific requirements.

A membership with Malta Chamber of SMEs will guarantee that you are constantly updated and informed with different opportunities which will directly benefit your business and help you grow. It also entails you to a number of services which in their majority are free of charge and offered exclusively to its members (in their majority all free of charge).